They use competitors’ P&L to gauge how well other companies are doing in their space and whether or not they should enter new markets and try to compete with other companies. Creditors, on the other hand, aren’t as concerned about profitability as investors are. Creditors are more concerned with a company’s cash flow and if they are generating enough income to pay back their loans. Below is a video explanation of how the income statement works, the various items that make it up, and why it matters so much to investors and company management teams. It is common for companies to split out interest expense and interest income as a separate line item in the income statement. An income statement should be used in conjunction with the other two financial statements.

- If a causal relationship is likely but cannot be reliably determined, the expense is reported in the year when it is incurred.

- Single-step income statements can be used to get a simple view of your business’s net income.

- Based on their analysis, they can come up with the best solutions to yield more profit.

- After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career.

- Being able to read an income statement is important, but knowing how to generate one is just as critical.

The Supreme Court upholds a tax on foreign income over a challenge backed by business interests

To determine your business’s net income, subtract the income tax from the pre-tax income figure. Enter the figure net income into the final line item of your income statement. This will give you a general understanding of your business performance, letting you see how profitable you have been. Other costs that would be counted under expenses would be operating and non-operating expenses.

Submit to get your retirement-readiness report.

An example of this would be the COGS expressed as 35% of the total revenue. This type of analysis can be useful when comparing with other companies in the industry. All public companies are required to file a Form 10-K each year with the Securities and Exchange Commission (SEC) and Form 10-Q each quarter which include what is the difference between biweekly and semimonthly payroll the income statement and other financial documents and disclosures. Earnings per share is a measure that compares a company’s net income compared to the outstanding shares. The price-to-earnings ratio, or P/E ratio, is another commonly used metric that factors in the company’s stock price in relation to EPS.

Income Statement Analysis FAQs

Whether each item is reported separately generally depends upon its materiality. Expenses represent the gross decreases in owners’ equity caused by operating events. Income tax https://www.kelleysbookkeeping.com/filing-taxes-as-a-self-employed-canadian/ returns accept several variations of cash accounting (including the installment method), meaning smaller firms frequently use them for reporting to their owners and creditors.

Indirect expenses like utilities, bank fees, and rent are not included in COGS—we put those in a separate category. This net income calculation can be transferred to Paul’s statement of owner’s equity for preparation. Finally, we arrive at the net income (or net loss), which is then divided by the weighted average shares outstanding to determine the Earnings Per Share (EPS).

Net income or net loss

Examples of gains are proceeds from the disposal of assets, and interest income. It starts with the top-line item which is the sales revenue amounting to $90,000. However, it uses multiple equations to determine the net profit of the company. Kavanaugh’s opinion left the issue of realization open and there are now four justices, one shy of a majority, who have declared their opposition to taxes, like a wealth tax, that don’t require realization. Greenberg pointed to a separate opinion from Justice Amy Coney Barrett, joined by Justice Samuel Alito, that agreed the Moores should lose this case. But Barrett also sided with the dissenters in arguing that income has to be realized — in essence, received — to be taxed in accord with the Constitution.

If there is a positive sum (revenue was greater than expenses), it’s referred to as net income. If there’s a negative sum (expenses were greater than revenue during that period), then it’s referred to as net loss. As you can see, this example income statement is a single-step statement because it only lists expenses in one main category. Although this statement might not be extremely useful for investors looking for detailed information, it does accurately calculate the net income for the year. An income statement is one of the most important financial statements for a company.

We’ve broken down the steps for preparing an income statement, as well as some helpful tips. EBITDA is not normally included in the income statement of a company because it is not a metric accepted by Generally Accepted Accounting Principles (GAAP) as a measure of financial performance. However, EBITDA can be calculated using the information from the income statement. Income statements are important because they show the overall profitability of a company and help investors evaluate a company’s financial performance. Income statements can also be used to make decisions about inorganic or organic growth, company strategies, and analyst consensus. With the income statement detailing the categories of revenues and expenses of a company, management is able to see how each department of a company is performing.

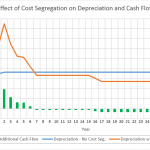

The income statement, also called the profit and loss statement, is a report that shows the income, expenses, and resulting profits or losses of a company during a specific time period. The income statement measures a company’s financial performance, such as revenues, expenses, profits, or losses over a specific period of time. This financial document is sometimes called a statement of financial performance. An income statement shows whether a company made a profit, and a cash flow statement shows whether a company generated cash. A single-step income statement is a simplified approach to viewing your net profit or loss.

Accountants and financial analysts usually prefer to look at your operating income—rather than your net income—to determine how profitable your company is. It’s frequently used in absolute comparisons, but can be used as percentages, too. The purpose of an income statement is to show a company’s financial performance over a given time period. Typically, multi-step income statements are used by larger businesses with more complex finances. However, multi-step income statements can benefit small businesses that have a variety of revenue streams. There are several ways multi-step income statements can benefit your small business.

As you move down your income statement, you’ll see that amount chipped away, used to pay for the cost of creating your products or services and keeping your company running. During the reporting period, the https://www.intuit-payroll.org/ company made approximately $4.4 billion in total sales. Vertical analysis refers to the method of financial analysis where each line item is listed as a percentage of a base figure within the statement.