These ten banking companies are offering a minimal mortgage rates having salaried people.

New Reserve Lender of Asia (RBI) provides directed every scheduled commercial banking companies (except local outlying finance companies), neighborhood financial institutions and you may brief money banking institutions to help you connect rates of interest of the many merchandising finance, along with mortgage brokers, given by them, to an outward counter.

Conforming with this directive, very commercial banking companies has opted for the latest RBI’s repo price because brand new external standard that all floating price financing try linked. Interest rates attached to the repo rates is known as repo price linked lending price otherwise RLLR. The newest RLLR includes repo rate also bank’s spread or margin. According to RBI, banking companies are allowed to fees a spread otherwise margin including exposure advanced over and above new exterior benchmark price out of borrowers.

Because give energized of the a specific financial remains exact same for every borrowers, the danger superior will differ from one person to another. For example, it’s always viewed you to financial institutions costs a higher risk premium away from self-employed borrowers as compared to salaried people.

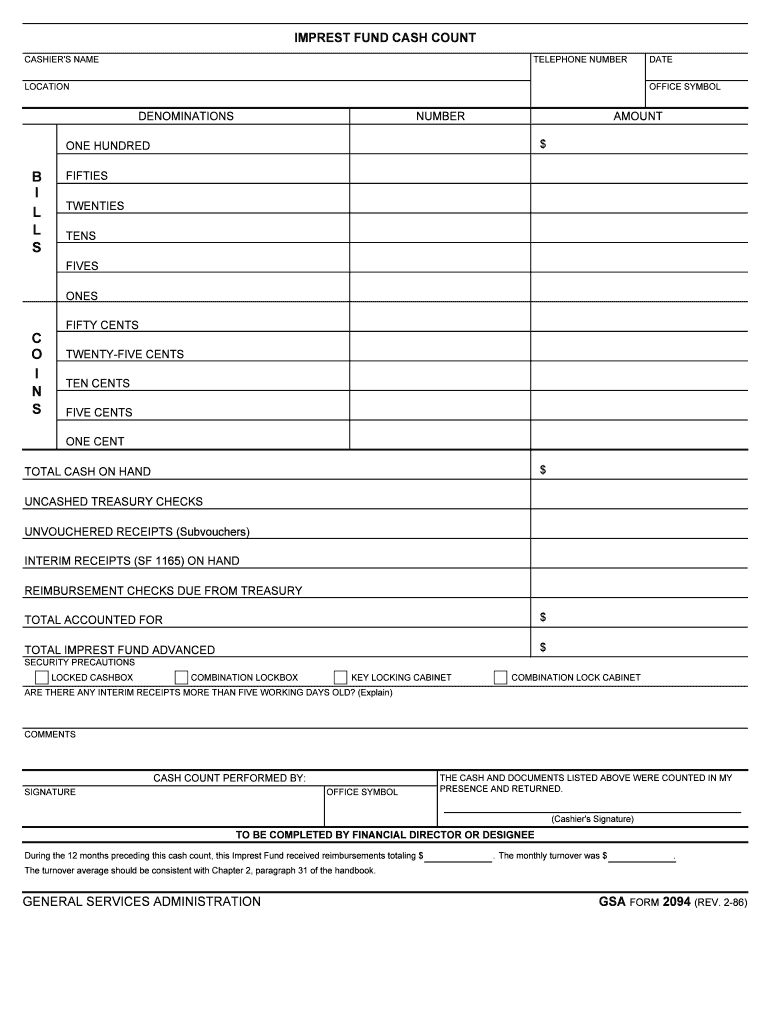

** Arranged to the minimal rate of interest energized from the financial shortly after incorporating exposure advanced*Lender out-of Baroda control charge are 0.25% to 0.50% off mortgage; Minute. Rs.8500/- Maximum. Rs.25000/-*Bank of India charge 0.25% out of amount borrowed as control fees; Min Rs 1,five-hundred and Max Rs 20,000/-* PNB charge 0.35% (minute Rs dos,five hundred and you will limitation Rs 15,000) in addition to paperwork charge Rs 1,350/-*Kotak Mahindra Lender charges a running percentage away from maximum dos% + GST and any other legal charges plus documents costs doing Rs.10,000/-*Connection Bank off India fees a control commission from 0.50% out-of loan amount, Maximum. Rs 15000*Lender away from Maharashtra costs a processing payment from 0.25% of Loan amount Maximum Rs.twenty-five,000/-*Punjab & Sindh Lender even offers the full waiver of running and you may evaluation charges*Canara Lender costs 0.50% as the control costs – minimum Rs step 1,five-hundred and maximum Rs ten,one hundred thousand.*HDFC Lender costs around 0.50% of the amount borrowed or Rs step 3,100000 whatever is actually large, and taxes*IDFC Basic Financial costs doing Rs 10,100000 (most premium billed centered on exposure profile) Every data sourced out of Monetary Moments Cleverness Group (ETIG)Study since to the

Why RBI took this decisionThe central lender took the choice to hook the pace out-of lenders or any other retail money so you’re able to an outward benchmark for deeper visibility and you may quicker transmission off the policy speed changes.

In earlier times, under the MCLR (marginal costs situated lending speed) regimen, of course RBI cut the repo price, banking institutions did not give the pros so you can users fast. Concurrently, whenever RBI hiked the fresh new repo rate, banks swiftly increased interest levels on fund.

With its rounded mandating banking institutions so you’re able to hook up fund so you’re able to an external standard, financial institutions can select from the following standards:

- RBI’s repo rate

- Authorities of Asia step three-day Treasury bill give published by Financial Criteria Asia (FBIL)

- Government regarding Asia six-month Treasury bill give compiled by FBIL

- Any benchmark sector interest rate penned FBIL

When is also borrowers’ EMI changes?According to RBI’s circular, finance companies must reset the home financing interest rates linked towards the additional standard at least once within the 3 months. This should imply that people improvement in brand new external standard speed needed to be mandatorily died toward consumer within this 90 days of one’s improvement in the brand new exterior standard.

Something different that affect the rate of interest on your mortgage recharged by financial can be your chance degree. Particular banking institutions keeps internal chance investigations communities who amount the chance group of the individual. Particular banks in addition to rely on credit history profile produced by borrowing from the bank bureaus. Therefore, while https://www.elitecashadvance.com/installment-loans-oh/nashville/ providing financing it is vital that you’ve got a beneficial good credit rating to possess a bank to costs lower chance advanced from you.

And additionally, if there’s a change in the fresh bequeath we.elizabeth. the newest margin billed by financial over and above this new outside standard price, this may be would change the interest rate charged for the loan removed from you.

Home loan cost: Listed below are top 10 banks’ financial interest rates into the 2022

Remember when your own borrowing-exposure assessment passes through good-sized alter inside tenure of the loan, then your financial normally inform the chance superior recharged.