The next financial is a kind of domestic guarantee loan personal debt which is a quick and easy way to find money and you will money from the home making use of the security that can be found. Such borrowing from the bank for household restoration resource becomes inserted toward into the identity of your house and you can is available in second condition from priority behind your current first mortgage financial. And therefore title, 2nd home loan.

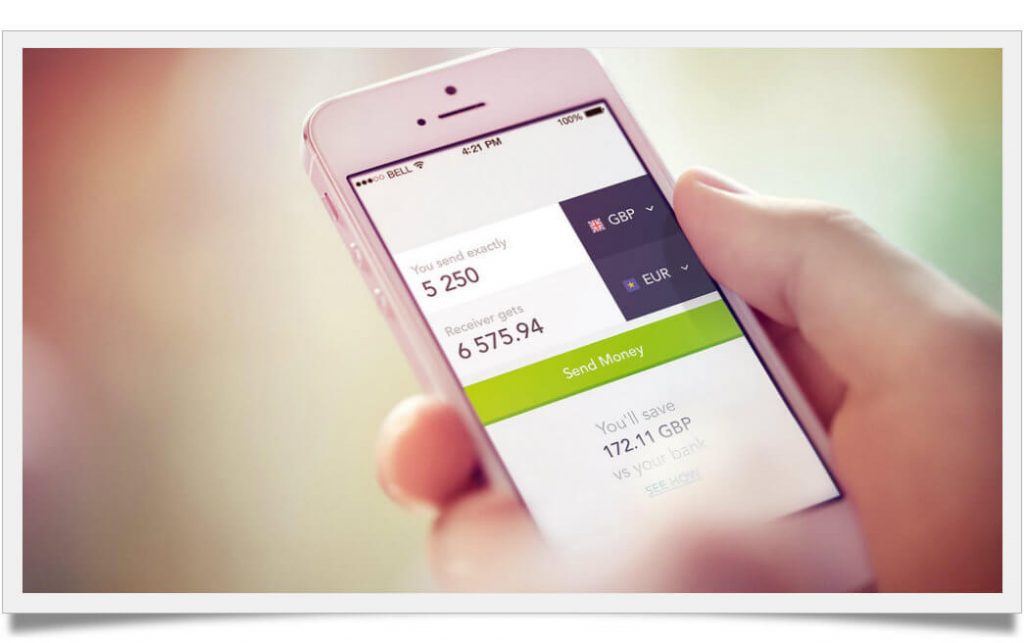

As a second mortgage is typically financed by an exclusive home loan bank, the application form techniques is simple and easy faster than simply implementing to own home financing refinance otherwise household security line of credit (HELOC) as a result of a bank. Since the individual mortgage brokers are apt to have much less rigorous qualifying requirements, and because they could be times investment-created bank, its top concern is typically the property itself rather than the credit history of one’s home loan borrower. Thus, in some instances, we could get you recognized to possess the second financial inside a beneficial few hours that will get financing financed inside while the absolutely nothing given that two days in some products. That is right, you could located the finance within 2 days in some instances.

By convenience and you can rates of going the next home loan with regards to renovating a property, this is exactly perhaps one of the most popular kinds of do-it-yourself investment into the Ontario.

Home loan refinance

A different sort of family collateral mortgage is actually a full home loan re-finance with the purposes of raising the dominating equilibrium of the first mortgage when planning on taking advantage of particular otherwise all readily available equity of your home. If your family features increased for the value as you got it, and/or you keeps paid down a fair number of brand new modern home loan equilibrium, then you’ll definitely has actually additional guarantee obtainable in your home you to definitely you are able to mark from. Refinancing owing to good AAA lender may also be helpful it will save you on desire costs.

The trouble which have refinancing a first home loan can often be you to it might take much longer and stay much harder to help you meet the requirements for than an additional financial, specially when trying to refinance the first mortgage by way of a lender or even more conventional financial institution. The benefit, but not, is the fact this would end up being the most affordable choice each other for a while and you can longterm.

HELOC (Home Guarantee Personal line of credit)

An excellent type domestic restoration mortgage into the Ontario that you need to understand ‘s the HELOC, also known as a property collateral line of credit. These types of guarantee financing uses the principle of lending situated into the security of your home to pay for their recovery. When going through a bank, that is an extended processes exactly like refinancing the first financial that have a bank. The main benefit here’s this are an unbarred and you may recyclable mortgage which allows you to have fun with whatever level of new readily available equilibrium need and want so you’re able to during the time right after which pay it back since you excite, if you result in the lowest monthly payments which are constantly appeal-only. http://speedycashloan.net/loans/600-dollar-payday-loan/ You only pay appeal to the currency which you use after you put it to use, as there are no punishment to pay down a share or any HELOC anytime. Whilst the interest rate are a little while higher than an everyday mortgage, this is a terrific way to put a flexible money product which you can use when.

Whenever protecting good HELOC thanks to an alternative financial otherwise individual financial, you will be purchasing higher rates of interest and additional charge and will cost you, but this will give you a significantly less and easier to view HELOC to possess day painful and sensitive purposes. You can even handle how much you are taking aside and how much you have to pay straight back. Even a tiny fees so you’re able to principal can save you attract will set you back ultimately.